Contracting strategies in a fraught market

Outline

This article covers the following:

Observations about the current market conditions for procuring major projects in the Territory and the market outlook;

Implications of our fraught market conditions for the procurement of infrastructure and major projects; and

Insights on strategies for dealing with our fraught market, gained from clients and others in the market that Infralegal is working with.

Market conditions for procuring major projects

The Northern Territory is its own market, with features that are unique to the Territory. But it is also affected by the broader markets of which it is a part, particularly market conditions for civil and heavy engineering services on Australia's East Coast, and global markets for these services.

The market for civil engineering services on Australia's East Coast has been fraught for the last 5 or so years.

Record levels of infrastructure spending by the NSW and Victorian Governments have seen demand for civil engineering services vastly exceed supply, creating a seller’s market. Sellers of these services have been able to be more selective about the clients they work for, and the project risks they will accept.

The level of risk that project owners could previously transfer to their contractors and suppliers has become very expensive, or impossible to achieve.

The rise of $1 billion plus mega-projects, often in complex urban environments, has increased the level of risk associated with the delivery of these projects.

And more recently, COVID-19 and the war in Ukraine has disrupted global supply chains, resulting in rising and highly volatile prices for materials and shipping. COVID-19 has also affected labour supply, adding to the fraught market conditions for major projects.

Looking forward, I expect government expenditure on transport infrastructure on our east coast to fall from its current record levels. But this will be more than offset by expenditure on energy transition infrastructure, as we build the renewable generation assets needed replace the coal fired power stations that power most Australian States, and the transmission lines needed to transport the energy from where its generated to where its consumed.

In short, our fraught market conditions are going to get worse.

Implications of our fraught market

Continued excess demand for engineering services means the providers of these services will continue to hold the whip-hand at the negotiating table.

Fierce competition for engineers and tradespeople will continue to drive up labour costs. Couple this with continuing volatility for the price of steel, concrete, timber and other building materials, and fuel and shipping costs - the aversion of contractors and suppliers to fixed price contracts will continue.

Those project owners and head contractors that continue to attempt to transfer project risks under fixed price contracts will find that the market will price risk more fully than in the past.

Project budgets will be blown and project start dates will be deferred, as owners reduce scope and revisit risk allocation to get tender prices back within budget.

Owners will need to consider alternative pricing models, such as cost reimbursement, provisional sum items, and rise and fall clauses.

The high cost of risk transfer will see more owners agreeing to share risks. This will lead to a desire for more collective decision making based on reaching consensus between project participants, rather than directives from above, on how shared risks should be managed. (Parties should be free to manage risks for which they are solely responsible, but parties will want to jointly manage shared risks).

Project finance

The sharing, rather than transfer, of cost and other risks by project owners will also have implications for how some projects are financed.

Project financiers have limited appetite for lending to borrowing entities that retain material risks.

Attempts by project owners to reduce project costs through risk sharing will be met with demands by project financiers for more equity capital, capable of full absorbing the potential consequences of retained risks.

The need for greater levels of equity will make some projects unviable.

Strategies for responding

I have three basic strategies to share.

1. Contract packaging

For many years, I've seen project owners prefer contracting structures that provide them with a single point of accountability for the project works - one person to blame if things go wrong.

I'm now seeing many of of these project owners opt for a contract packaging structures that break the project into several separate contract packages.

Doing this can increase competition for the work, and thereby improve value for money.

Projects that couldn't attract more than one bidder are able to be competitively tendered. Contractors that couldn't bid for the fully-bundled contract can bid for and deliver a separated package, without the complications of needing to form joint ventures with other contractors.

2. Finance on a potfolio basis

I'm seeing a number of project developers raising debt finance for their projects on a portfolio basis, rather than a project by project basis.

Doing this allows the project developer to share various risks on each project with its contractors, but then spread those risks across its portfolio of projects. For example, adverse ground conditions might be experienced on one project, but they are unlikely to be experienced on every project in the portfolio.

Lenders are able to get comfortable with the risk sharing arrangements on each project on the basis that it is one of a number of projects in the portfolio, and that the combined cash flow position across the portfolio will be sufficient to absorb risks that may occur on particular projects.

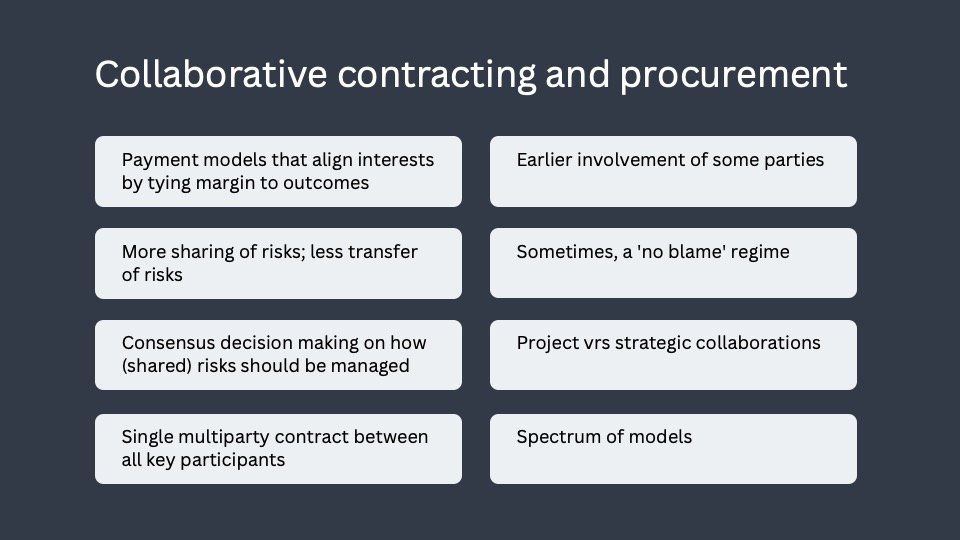

3. Collaborative contracting and procurement techniques.

Project owners are increasingly deploying collaborative contracting and procurement techniques in response to our fraught market.

Some of the techniques are listed below.

Collaborative techniques include the development of alternative payment models that separate the cost recovery component from the margin component, and wire the margin component so that margin is linked to the project outcomes that the owner is seeking, such as cost, time and quality optimisation.

Collaborative contracting involves greater sharing of risks between the project participants, and less risk transfer to specific project participants.

As mentioned before, greater sharing of risks among project participants leads to a desire by the participants to have a say over how the shared risks are managed. Accordingly, collaborative contracting tends to involve more consensus-based decision making, where decisions require the unanimous agreement of all relevant stakeholders.

Collaborative contracting often involves multiparty contracts between all key stakeholders, rather than hierarchal tiers of two-party contracts. Multiparty contracts can provide the overarching framework and commercial incentives needed to bring key stakeholders together and align interests around the the management of risks and opportunities associated with projects and longer term ventures.

Collaborative procurement often involves the earlier involvement of certain project participants than is typically seen under more traditional procurement models. The earlier involvement of contractors and key suppliers in the project planning, scoping and design processes tends to avoid adverse downstream consequences associated with earlier decisions, such as buildability issues arising from poor design.

Collaborative contracts can include a no-blame clause that prevents the participants from suing one another when things go wrong, even if one participant has breached its obligations or been negligent.

This clause is designed to stop the blame game that occurs when things go wrong, and instead force the participants to focus on developing the solution that will optimise the outcomes.

The parties place their faith in the agreed commercial arrangements driving the desired behaviours, rather than contractual obligations with penalties for non-compliance. The non-owner participants are motivated to collaboratively solve the problem, because that's the way by which their margin entitlements will be maximised.

Collaborative contracting arrangements can be put in place for a single project, or they can be more strategic and longer term in nature. Infralegal is presently advising a number of clients on long term strategic collaboration contracts for business ventures that will involve successive projects over many years.

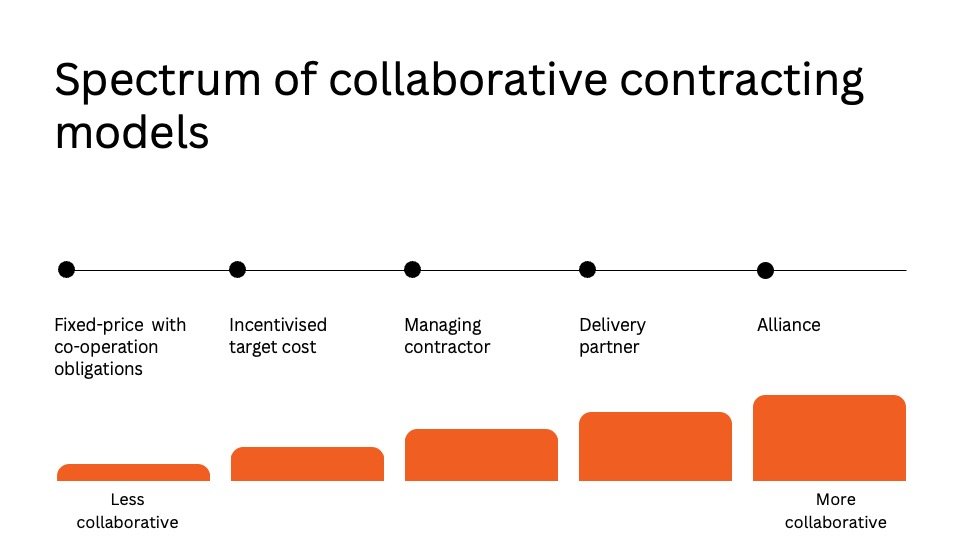

Finally, it should be understood that there is no single collaborative contracting model. For key issues like cost, time, quality, decision making and liability there are a spectrum of approaches that can be adopted, some of which are more (or less) collaborative than others.

The below diagram shows the spectrum, but at a high level only. It lists five common contract delivery models and shows where they sit on the spectrum - from less collaborative to more collaborative.

Take aways

I have three take-aways for you:

Our fraught market conditions for procuring major projects are going to get worse.

Our fraught market has significant implications for project developers and participants - that need to be addressed.

But with the right strategies, project owners and participants can succeed despite the fraught market.

The above is an edited version of the presentation that Owen Hayford delivered at the 11th Annual Major Projects Conference in Darwin on 19 November 2022.